Hi! We're

Matt and John

We're creative technologists probably best known for our crypto art projects the CryptoPunks and Autoglyphs.

MORE ABOUT US

The Cryptopunks

10,000 unique collectible characters with proof of ownership stored on the Ethereum blockchain.

READ MORE

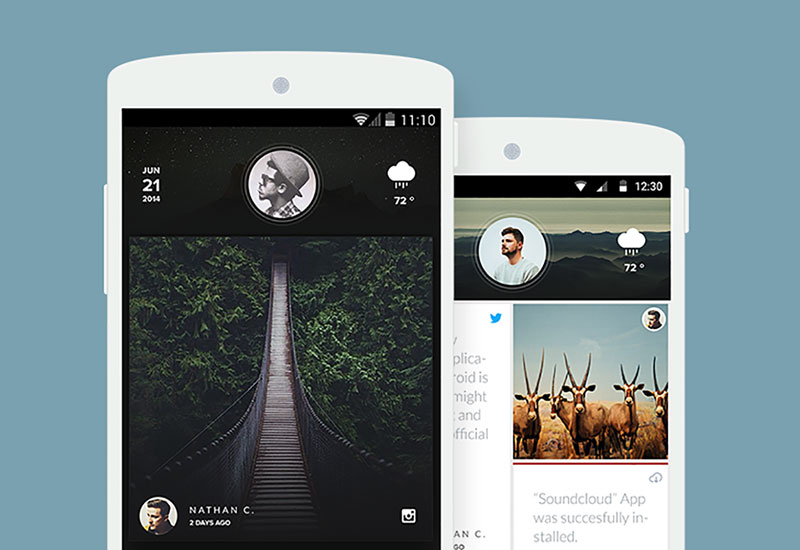

Data Visualizations for Flutter Web

An interactive data visualization created for Google to launch Flutter Web at I/O 2019.

READ MORE

Androidify

with Google

A small internal project with Google that grew to become the face of the Android global brand.

READ MORE